Florida Memory is administered by the Florida Department of State, Division of Library and Information Services, Bureau of Archives and Records Management. The digitized records on Florida Memory come from the collections of the State Archives of Florida and the special collections of the State Library of Florida.

State Archives of Florida

- ArchivesFlorida.com

- State Archives Online Catalog

- ArchivesFlorida.com

- ArchivesFlorida.com

State Library of Florida

Related Sites

Description of previous item

Description of next item

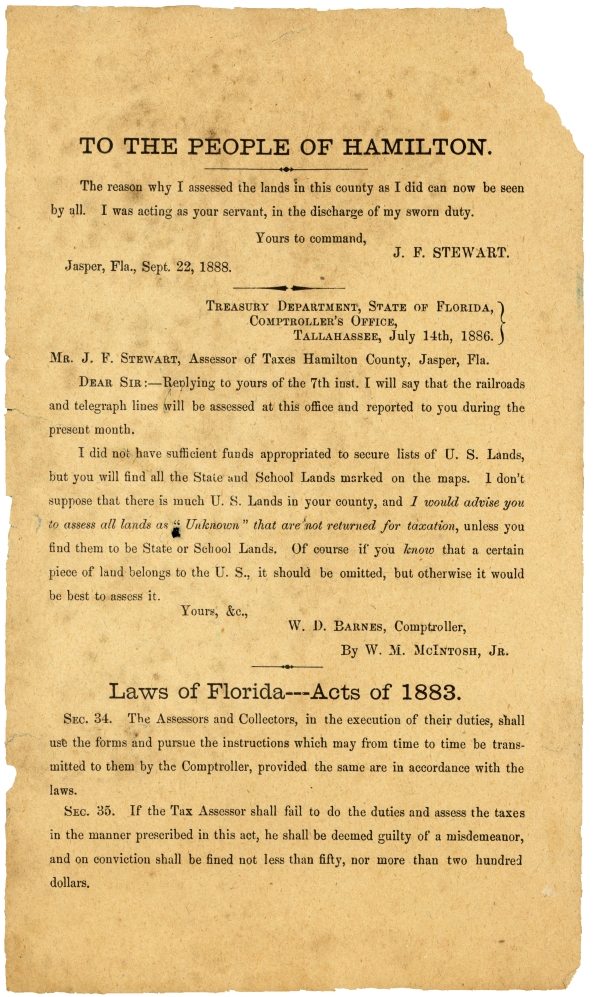

Circular letter to the citizens of Hamilton County, Florida from Tax Assessor J.F. Stewart

Source

State Library of Florida, Florida Collection, BR0044

Description

Circular to explain the taxation of land in Hamilton County. Includes letter from State Comptroller to Mr. J.F. Stewart, Assessor of Taxes, Hamilton County and a copy of Laws of Florida Acts of 1883, sections 34 and 35.

Date

1888

Format

Topic

Geographic Term

To the People of Hamilton. The reason why I assessed the lands in the county as I did can now be seen by all. I was acting as your servant, in the discharge of my sworn duty. Yours to command, J.F. Stewart. Jasper, Fla., Sept. 22, 1888. Treasury Department, State of Florida, Comptroller's Office, Tallahassee, July 14th, 1886 Mr. J. F. Stewart, Assessor of Taxes Hamilton County, Jasper, Fla. Dear Sir: --Replying to yours of the 7th inst. I will say that the railroads and telegraph lines will be assessed at this office and reported to you during the present month. I did not have sufficient funds appropriated to secure lists of U.S. Lands, but you will find all the State and School Lands marked on the maps. I don't suppose that there is much U.S. Lands in your county, and I would advise you to assess all lands as "Unknown" that are not returned for taxation, unless you find them to be State or School Lands. Of course if you know that a certain piece of land belongs to the U.S., it should be omitted, but otherwise it would be best to assess it. Yours, &c., W.D.Barnes, Comptroller, By W.M. McIntosh, Jr. Laws of Florida - Acts of 1883 Sec. 34. The Assessors and Collectors, in the execution of their duties, shall use the forms and pursue the instructions which may from time to time be transmitted to them by the Comptroller, provided the same are in accordance with the laws. Sec. 35. If the Tax Assessor shall fail to do the duties and assess the taxes in the manner prescribed in this act, he shall be deemed guilty of a misdemeanor, and on conviction shall be fined not less than fifty, nor more than two hundred dollars.

Title

Circular letter to the citizens of Hamilton County, Florida from Tax Assessor J.F. Stewart

Subject

Finance, Public

Taxation

Description

Circular to explain the taxation of land in Hamilton County. Includes letter from State Comptroller to Mr. J.F. Stewart, Assessor of Taxes, Hamilton County and a copy of Laws of Florida Acts of 1883, sections 34 and 35.

Source

State Library of Florida, Florida Collection, BR0044

Date

1888

Format

circular letters

Language

eng-US

Type

Text

Identifier

flc_br0044

Coverage

Late 19th-Century Florida (1877-1900)

Geographic Term

Jasper (Fla.)

Hamilton County (Fla.)

Thumbnail

/fmp/selected_documents/thumbnails/flc_br0044.jpg

Display Date

published 1888

ImageID

flc_br0044_01

topic

Politics and Government

Subject - Corporate

Florida Comptroller

Subject - Person

Barnes, W. D.

Transcript

To the People of Hamilton. The reason why I assessed the lands in the county as I did can now be seen by all. I was acting as your servant, in the discharge of my sworn duty. Yours to command, J.F. Stewart. Jasper, Fla., Sept. 22, 1888. Treasury Department, State of Florida, Comptroller's Office, Tallahassee, July 14th, 1886 Mr. J. F. Stewart, Assessor of Taxes Hamilton County, Jasper, Fla. Dear Sir: --Replying to yours of the 7th inst. I will say that the railroads and telegraph lines will be assessed at this office and reported to you during the present month. I did not have sufficient funds appropriated to secure lists of U.S. Lands, but you will find all the State and School Lands marked on the maps. I don't suppose that there is much U.S. Lands in your county, and I would advise you to assess all lands as "Unknown" that are not returned for taxation, unless you find them to be State or School Lands. Of course if you know that a certain piece of land belongs to the U.S., it should be omitted, but otherwise it would be best to assess it. Yours, &c., W.D.Barnes, Comptroller, By W.M. McIntosh, Jr. Laws of Florida - Acts of 1883 Sec. 34. The Assessors and Collectors, in the execution of their duties, shall use the forms and pursue the instructions which may from time to time be transmitted to them by the Comptroller, provided the same are in accordance with the laws. Sec. 35. If the Tax Assessor shall fail to do the duties and assess the taxes in the manner prescribed in this act, he shall be deemed guilty of a misdemeanor, and on conviction shall be fined not less than fifty, nor more than two hundred dollars.

Chicago Manual of Style

Circular letter to the citizens of Hamilton County, Florida from Tax Assessor J.F. Stewart. 1888. State Archives of Florida, Florida Memory. <https://www.floridamemory.com/items/show/212290>, accessed 4 December 2024.

MLA

Circular letter to the citizens of Hamilton County, Florida from Tax Assessor J.F. Stewart. 1888. State Archives of Florida, Florida Memory. Accessed 4 Dec. 2024.<https://www.floridamemory.com/items/show/212290>

AP Style Photo Citation

Listen: The World Program

Listen: The World Program